Whether Article 9(1) is illustrative or restrictive!

Article 9(1) of the MC states the ALP that is applicable to commercial and financial relations between

associated enterprises and sets the ALP as the allocation norm. Thus, in situations, where the prices

charged in transactions between associated enterprises differ from the prices (arm’s-length prices) that would be charged in similar or comparable transactions between unrelated or independent enterprises, profits can be adjusted to reflect the true profits that would have been earned if the transactions had taken place at arm’s length.

The interplay of Article 9(1) with the other articles of the tax treaty also depends on whether Article 9(1) should be considered as restrictive or illustrative in nature. Views do exists on both side of the proposition, the same has been presented below:

- Article 9(1) is restrictive:

Article 9(1) should be considered as restrictive in nature as it covers only TP adjustments and not the transactional adjustments. (i.e. Article 9(1) prohibits adjustments to the profits of an enterprise in excess of an arm’s-length amount (for example, by denying or limiting the deduction of interest paid by a resident to an associated non-resident)[1]). Further, in Para 2 of the OECD MC, it is stated that ‘No re-writing of the accounts of associated enterprises is authorized if the transactions between such enterprises have taken place on normal open market commercial terms (on an arm’s length basis)’. In this regard, Prof. Klaus Vogel also suggested that the treaty provision will act only as a safeguard that any adjustments made will not go beyond the arm’s length standard[2]. Hence, adjustments for an amount exceeding ALP should not be permitted. Further, even if one is to look at Article 25 of the MC, it requires the condition of ‘taxation not in accordance with the provision of this convention………………….’ So, if Article 9(1) is not read as restrictive, then how possibly will a primary adjustment beyond arm’s length ever ‘not be in accordance with the provision of this convention’? Moreover, it would be difficult for Article 7 to restrict the authority of a country in which a PE is located to tax an amount in excess of the arm’s length profits attributable to the PE, but not for Article 9 to do so with respect to associated enterprises; if provisions of Article 9 are not restrictive.[3] In this context, Wittendorff further clarifies that since Article 7(2) requires the contracting state to comply with the arm’s length principle, the legal effect of Article 9(1) must be the same[4].

Furthermore, as mention earlier in Section 1 that OECD MC Commentary also states that: ‘The application of rules designed to deal with thin capitalisation should normally not have the effect of increasing the taxable profits of the relevant domestic enterprise to more than the arm’s length profit, and that this principle should be followed in applying existing tax treaties[5]’. This paragraph also in a way confirms the restrictive nature of Article 9 on domestic provisions/ rules.

- Article 9(1) is illustrative:

Article 9(1) in no way preclude a country from taxation of profits of its resident entities for amount that are in excess of arm’s length amount because it only provides for a non-binding statement in relation to the arm’s-length principle and a outline for the adjustment of profits[6]. There is convincing indications in the OECD MC, in particular reference several of countries that interpret the article such that it does not bar a profit adjustment under the national s under different conditions.[7] Further, in the commentary on Article 9(2), it is recognized that countries might tax more than the arm’s-length profits of an enterprise and indicates that in such situations, the other country might not obliged to provide for a corresponding adjustment [8]. Also in Article 9(1), the use of permissive word ‘may’ has been made instead of the use of mandatory word ‘shall’[9]. In normal parlance, it is generally understood that where the use of words may has been referred, the provisions may in such situations may not be interpreted as restrictive rather they are should be interpreted as illustrative. Pertinent to mention, Article 9 is different from the other distributive rules of the treaty in that it deals with the allocation of taxing rights between two residence countries, whereas the other rules deal with the allocation of taxing rights between the source and residence countries. Nevertheless, it might be conflicting to the notion that tax treaty does not restrict a country’s rights to tax its own residents unless it does so explicitly, if Article 9 were to be interpreted in the restrictive manner[10]. This is also pertinent from the wording of Article 1(3) (where ever Article 1(3) is present) and Article 1(3) does not have an exception for Article 9(1). Thin Capitalisation Report also stated that Article 9(1) of the OECD MC was also relevant for determining whether a loan could be recharacterized as equity capital and not only for determining the interest rate.[11]

Comments: Prima facie, it seems that an illustrative interpretation may make Article 9(1) superfluous, thereby making its existence meaningless. Such a view may not be consistent with the primary purposes of Article 9 as well. This view was also supported in the General Report for the IFA Congress 1992[12], wherein it is agreed that Article 9(1) should not be construed as being merely illustrative. Incidentally, this also seems to be the prevailing opinion in the General Report for the IFA Congress 1996[13].

However, with Article 1(3) i.e. saving clause in the tax treaties, it is yet to seen that how the provision of Article 9(1) may be considered as restrictive with no exceptions in the relation of its applicability for Article 9(1).

[1] Brian J Arnold, ‘The Relationship Between Restrictions on the Deduction of Interest Under Canadian Law and Canadian Tax Treaties’ (2019) 67 Canadian Tax Journal/Revue fiscale canadienne, p.1072.

[2] Reference in this regard can be placed on K. Vogel, Klaus Vogel on Double Taxation Conventions: A Commentary to the OECD, UN and US Model Conventions for the Avoidance of Double Taxation on Income and Capital with Particular Reference to German Treaty Practice, 3rd ed. (Kluwer), Para 7, Commentary on Article 9, p. 517

[3] Johannes Becker, Ekkehart Reimer and A Rust, Klaus Vogel on Double Taxation Conventions (Kluwer Law International (2015).p.603.

[4] J. Wittendorff, The Transactional Ghost of Article 9(1) of the OECD Model, 63 Bulletin for International Taxation. 3, (2009), p. 112.

[5] OECD (2017), Model Tax Convention on Income and on Capital: Condensed Version 2017, Commentary on Article 9 para 3(c).

[6] Arnold (n 17), p. 1072.

[7] OECD (2017), Model Tax Convention on Income and on Capital: Condensed Version 2017, Commentary on Article 9 para 4.

[8] Reference in this regard can be placed on OECD (2017), Model Tax Convention on Income and on Capital: Condensed Version 2017, Commentary on Article 9 para 6., p. 227.

[9] Georg Kofler and Isabel Verlinden, ‘Unlimited Adjustments- Some Reflections on Transfer Pricing, General Anti-Avoidance and Controlled Foreign Company Rules, and the Saving Clause’ (2020) 74 Bulletin for International Taxation, p.275.

[10] Reference in this regard can be placed on OECD (2017): Model Tax Convention on Income and on Capital (Condensed version) Commentary on Article 1, Para. 18 p 59.

[11] Thin Cap Report (n 17) paras. 48-49.

[12] Guglielmo Maisto, ‘Transfer Pricing in the absence of comparable market prices: General Report, in IFA, Cahiers de Droit Fiscal International, (1992) Vol. 77a, p. 60-61.

[13] Detlev J. Piltz, International aspects of thin capitalisation: General Report, in IFA, Cahiers de Droit Fiscal International, (1996) Vol. 81b, p. 69.

Is there a need to revisit Arm’s Length Principle? (Part 1)

- Introduction

Arm’s length principle (‘ALP’) was introduced a century ago to ensure proper allocation of taxing rights and it lies as the basis of transfer pricing legislation[1]. ALP is still considered as the ‘…heart, spirit and foundation of the current international transfer pricing system’, however, the question that arises is how efficient and appropriate are such ALP rules for allocation of taxing rights in today’s world.

Introduced in United States as a standard so that an uncontrolled taxpayer would always deal at arm’s length with another uncontrolled taxpayer, it later found a place in the OECD Model convention (‘OECD MC’). Article 9 of the OECD MC contains the authoritative statement for ALP as per which it is a principle that applies to a controlled transaction to determine whether the price of that transaction would have been agreed on between independent parties in the open market to ascertain international income is fairly allocated. From Article 9 of the OECD MC, we can also conclude that it is the foundation for the comparability analysis because it initiated the requirement of[2]: ‘A comparison between conditions (including but not only prices) made or imposed between associated enterprises and those which would be made between independent enterprises, to determine whether the determination of profits is at arm’s length’

2. Criticism that exists for ALP :

It is often criticized that ALP no longer fulfils the objective for which it was created i.e. allocation of taxing rights in a fair manner and hence the principle needs to be re-visited. The broad arguments that critics take in this regard are :

- Reflecting the economic reality of the transaction :

- How adequately arm’s length principle reflects the economic reality, especially in the current economic environment (For ex. – In transactions involving intangibles which are becoming an ever-more dominant value driver for multinationals (‘MNEs’))

- The principle does not take into account the economic interdependence between related entities.[1] It still sticks on separate legal entity concept, however, in today’s world where transactions/ operations are so integrated, it is no longer feasible to rely on separate legal entity concept, in various situations.

- Consideration of demand-side factors :

Pillar One approach of the OECD secretariat also resonates with the OECD’s thoughts of markets contributing value to the MNEs value chain. Due to digitization, the idea of taxing markets have become further challenging as digital platforms can create size without mass and are directed toward one predominant objective i.e. the alignment of the jurisdiction where income is reported for tax purposes with the place where value is created (Discussed in section 3 in detail).

Pertinent to mention, ALP which is based on Function, Assets and Risk (‘FAR’) analysis takes into account only supply-side factors while demand-side factors (such as sales) are ignored. There is a need to move from FAR to a FARMapproach that would add a market factor also to the FAR analysis. Thus, the market state shall also obtain the right to tax certain part of the profit linked to sales in other state based on the nexus.

- Harmonization issue[2] : ALP’s inclusion into domestic law or treaty law and the application of the OECD guidelines to the principle creates certain harmonization issues (For ex. : differences in the domestic tax system of the countries makes it difficult to harmonize the application of the ALP approach worldwide). Such issues can be categorized into the following situations:

- Situations where there is provision both in domestic law and tax treaty that incorporate the arm’s length principle, but they differ in wording and effect;

- Situations where the domestic[MS1] law provisions are themselves inconsistent with the arm’s length principle.

While some of this criticism may be regarded as a weakness of ALP, however other weaknesses have been discussed in section 4.

3. Alignment of ALP with value creation

With Action plan 8-10[3] it seems that a new standard to allocate profits from transactions based value-creation principle vis-à-vis functions performed rather than finding comparable transactions based on ALP seems to have been laid down. However, BEPS Project Actions 8 – 10 also reaffirms that ALP is the conceptual core of global transfer pricing principles, as ALP has proven over time to be the acceptable way of reaching an agreement for allocation of taxable income among group entities operating in different states.

The purpose of value creation is to find the true nature of the actual controlled transaction while ALP refers to what the unrelated parties would have done in comparable circumstances. Thus, it is difficult to reconcile both concepts. Value creation, unlike the ALP leaves no room for any hypothetical transaction. On the contrary, it may be said that value creation is a way to predefine the transfer pricing rules, or possibly more accurately, to predefine the method as a method based on functions performed, the capacity to perform those functions and the market for the product or service. It rather reflects the profit allocation character of the ALP.

In all, the following question arises –

- Whether the alignment of Transfer pricing rules with value creation will lead to the allocation of profits in accordance with the ALP

- Whether reconciliation between economic activities that gave rise to income/ profits and tax jurisdictions in terms of value creation would prevent the profit shifting

[1] De Wilde (2015) ‘In these early days of international taxation the League of Nations, as the ‘predecessor’ of the United Nations and the OECD, drafted the first Model Tax Conventions on Income and Capital’, p.6

[2] J Pleune, ‘The Desirability of the Arm ’ s Length Principle in the 21 St Century’, pg 12-13

[3] Charles E McLure ‘Replacing Separate Entity Accounting and the Arm’s Length Principle with Formulary Apportionment’ [2002] BFIT 586 at 586

[4] Reference for this has been drawn from paper Duran Timms, ‘The harmonisation of Transfer pricing : The obstracles , the arm’s length principle and the OECD guidelines’.

[5] OECD, Aligning Transfer Pricing Outcomes with Value Creation, Actions 8-10 – 2015 Final Reports, OECD/G20 Base Erosion and Profit Shifting Project (2015).

Controlled foreign corporation rules – Part 3

Select jurisdictions CFC rules

CFC legislation is adopted in many countries although with some differences. It is important to analyse the practices followed by different state and to understand the similarities and differences in measures opted by different countries.

CFC rules were first introduced as ‘Subpart F’ legislation in the United States in 1964. Germany followed in 1972 using the US rules as a blue print. In 2013, more than 30 countries worldwide used CFC rules to limit profit shifting by multinational corporations[1] . The number of countries introducing CFC rules has been growing since then.

A bird’s eye view of the CFC rules of some of the jurisdictions has been tabulated below –

| Country | Description |

| United states | – CFC rules were initially enacted in 1960 with the purpose of gathering information about U.S. companies overseas – Under the U.S. rules, a foreign entity is considered a CFC, if 50 percent or more of vote or value is controlled by U.S. shareholders – A U.S. shareholder is a U.S. person who owns 10 percent of more of vote or value in the company – Once an entity is categorized as a CFC, income that falls into one of the categories as Subpart F income must be included in the gross income of the parent company and taxed at the U.S. rate. CFC income is determined at the entity level and then attributed to a U.S. shareholder to be taxed in the U.S. |

| Germany | – CFC rules were initially enacted in 1972 – Under the German regime, a CFC is a foreign company where its capital or voting rights are either directly or indirectly majority-owned by German residents at the end of its fiscal year. The rules apply if the company generates passive income, and its income is taxed below the 25 percent threshold – German CFC rules apply if a German company directly or indirectly holds 50% or more of the voting rights in a foreign affiliate and if this affiliates faces an effective tax rate of less than 25% (being calculated according to German tax base measures). If the foreign company earns passive income, that passive income is immediately included in the corporate tax base of the German parent company and taxed at the German tax rate – no matter where the passive income effectively accrued |

| France | – CFC rules were initially enacted in 1980, France was the fourth country after the U.S., Germany and Canada to incorporate such rules into its tax system – France enacted CFC rules as a legislative response to the abusive use of its participation exemption regime – CFC Rules in France apply to foreign subsidiaries or permanent establishments of a French company that are controlled by a French parent company |

| United Kingdom | – France’s enactment of CFC rules was followed by the UK in 1984 – The initial purpose of the rules in the UK was apparently due to the creation of offshore money boxes—paper regimes that led to capital exports, while allowing business to otherwise carry on unaffected |

| China | – Enacted in 2008, to be considered a CFC, the company must be effectively controlled by one or more Chinese residents by ownership, capital, business operations, or authority over purchase and sales-related matters – The rules were created to prevent Chinese multinationals from leaving profits in low-tax jurisdictions through various arrangements without business substance, but the application of the rules is not common |

| Japan | – Brought up in 1978, CFC status is determined either by an equity ownership test or a de facto control test – The control requirement to categorize a foreign resident company (FRC) as a CFC is 50 percent of direct or indirect control of the Japanese shareholders over the company. A Japanese shareholder is a company or any associated person that holds 10 percent or more of the outstanding shares of the CFC |

| Dutch | – The country did not have a CFC regime until it was made mandatory by anti-tax avoidance directive (ATAD) for 2019 – A foreign company or a permanent establishment is considered a CFC for Dutch law purposes when the entity is a tax resident in a jurisdiction without a corporate income tax, or tax resident in a jurisdiction with a statutory corporate income tax rate of lower than 9 percent, or tax resident of a jurisdiction included in the EU blacklist of non-cooperative jurisdictions – A foreign entity is considered a CFC if a Dutch corporate taxpayer has a direct or indirect interest of more than 50 percent in a low-taxed foreign subsidiary or PE |

[1] See KPMG (2008) for a brief survey of institutional details. Lang et al. (2004) offer a detailed discussion of CFC rules from a legal perspective.

Controlled foreign corporation rules – Part 2

Example

Where a resident(s) of Country A is able to influence or control an entity that is resident(s) of Country B, including the profit distribution or repatriation policies of such controlled company, the income of such company may not be distributed and brought into Country A and remain outside the scope of its taxation. CFC rules are framed to enable Country A to tax its residents on the undistributed income of the company that they control, but which are located in Country B.

If a business headquartered in Country A (with a combined corporate income tax rate of 32.02 percent) has a subsidiary in the Country B (which does not tax corporate income), Country A in certain cases may assert the right to tax the income earned by the Country B subsidiary.

Work of OECD and European union for CFC rules

- OECD BEPS project and Action Plan 3 –

OECD BEPS Action Plan 3 refers to possible ways to implement CFC rules and contains set of recommendations that divides the constituent element of the rules. The Action plan recognises that by working together countries can address concerns about competiveness and level the playing field. This report sets out recommendations in the form of building blocks. These recommendations are not minimum standards, but they are designed to ensure that jurisdictions that choose to implement them will have rules that effectively prevent taxpayers from shifting income into foreign subsidiaries. The report has set out six building blocks for the design of effective CFC rules. They are as follows –

(i) Definition of CFC

(ii) CFC exemptions and threshold requirements

(iii) Definition of income

(iv) Computation of income

(v) Attribution of income

(vi) Prevention and elimination of double taxation

The report contains two standards to define a CFC.

- The first standard is used to determine which entities are defined as CFCs

- The second standard includes the definition of control and the different ways in which control can be measured (either directly or indirectly) with a threshold of 50 percent and the probability to be measured from a legal and economic standpoint

Also, the recommendations provide flexibility to implement CFC rules that combat BEPS in a manner consistent with the policy objectives of the tax system of the country concerned. Once implemented, the recommendations seeks to ensure that countries have effective CFC rules that address BEPS concerns.

- Work of European union –

European Union (‘EU’) Council in year 2010 has issued a resolution following the recommendations of the European Parliament and the Economic and Social Committee (‘ECOSOC’) regarding the coordination of CFC rules and thin capitalization rules in the European Union.

European Commission (the ‘Commission’) in year 2016 presented a proposal to incorporate CFC rules in all EU member countries as part of a package of tax anti-avoidance measures. Six months later the European Council adopted the Anti-tax avoidance directives (‘ATAD’) (EU 2016/1164)85 laying down rules against tax avoidance practices that directly affect the functioning of the internal market. The directive contains five legally binding anti-abuse measures, which all member states are required to adopt to combat common forms of aggressive tax planning. Included in the directive are CFC rules.

Article 7 of ATAD describes CFC to be a foreign entity or permanent establishment (‘PE’) of which the profits are not subject or exempt from tax, if the shareholder holds directly or indirectly (or with associated enterprises) a participation of 50 percent of the voting rights, capital, or profits of an entity. A second requirement to qualify as a CFC is that the corporate tax paid by the entity on its profits is lower than the difference between the corporate tax that would have been charged on the entity by the member state under the applicable tax system of the taxpayer or the actual corporate tax paid by the entity on its profits.

The directive proposes two alternative ways for member states to implement a CFC regime. They are –

- The first alternative focuses on passive income earned by an entity that qualifies as a CFC, which means that certain kinds of income earned by the CFC that are not distributed during a taxable year have to be included in the tax base of the shareholder.

- The second alternative targets the non-distributed income of a CFC that arises from non-genuine arrangements that have been in place for the essential purpose of obtaining a tax advantage.

The main purpose of the ATAD directive is to create certain level of protection against corporate tax base erosion and profit shifting throughout the EU more stable environment for businesses.

Mutual Agreement Procedures: Unravelling the concept and the developments surrounding it – Part 1

- Background

- International double taxation occurs where two countries seek to tax income from the same cross-border transaction or activities. Bilateral tax treaties endeavour to resolve this issue. Most tax treaties are structured on the basis of the OECD Model Convention, the UN Model Convention or some variation of these. These limit the rights of the source state to tax income arising within its territory and require the residence state to allow credit for the source taxes or to exempt income subject to source taxation.

- The design of sensible tax policies for modern economies require that careful attention be paid to their international ramifications. This is a potentially daunting prospect, since the analysis of tax design in economies entails all of the complications and intricacies that appear in closed economies, with the addition of many others, since multiple, possibly interacting, tax systems are involved. Given the multiplicity of regulations at play, effective dispute resolution framework should be in place to promote a stable tax regime.

- Mutual Agreement Procedures (‘MAP’) is a mechanism for competent authorities to discuss cross-border taxation of specific transactions or situations with a view to coordinate their approach for the benefits of the taxpayers involved. In a MAP, representatives from each of the contracting states are designated and are referred to as Competent Authorities. This process is available under a tax treaty entered into by two or more countries so that the treaty partners are able to resolve cases involving their taxpayers where there are disputes concerning cross-border transactions in their countries. MAP is ‘a process of discussion between the competent authorities in which they seek to explore the possibilities of a solution to the relevant problem that can be accepted by all concerned’. Explicitly not precedent-setting, it is nevertheless vital to the process that MAP outcomes become binding on the parties, lest the entire process become an exercise in futility.

- The typical areas covered[1] under a MAP are as follows:

- Double taxation that could arise from a transfer pricing adjustment: It occurs when a taxpayer is subject to additional tax in one country because of a transfer pricing adjustment to the price of goods or services transferred to or from a related party in the other country

- Issues pertaining to determination of residential status under the tax treaty/ Issues arising on account of dual residency: It arises when a person is resident of two treaty countries under each country’s domestic law, and each country asserts that the taxpayer is a resident of its jurisdiction for purposes of the tax convention. A request to the competent authorities would initiate discussions between the competent authorities regarding the proper application of the tiebreaker rules contained in the residency article of the convention. The taxpayer should approach the competent authority of the country in which the taxpayer asserts residency and in some cases where it is incorporated.

- Dispute on the characterisation of income: Because of the complexity involved in the cross border transactions, often a situation arises in which taxpayer is unsure of the characterisation or classification of the item related to a cross-border issue; the taxpayer may approach the competent authority for clarification.

- Dispute in relation to existence of a Permanent Establishment (PE) in one of the contracting States: A taxpayer subject to tax as a resident in one country on income, including income from carrying on a business in the other treaty country, is taxed in that other treaty country on the business income earned there, despite not having a permanent establishment in that country under the tax convention. The taxpayer may request the competent authority of its country of residence to address the issue of taxation not in accordance with the tax convention with the competent authority of the other country.

- Structure of the article on Mutual Agreement Procedures

- Article 25 of the OECD/ UN Model Convention is a very important procedural provision as it provides for the framework of a ‘mutual agreement procedure’ which enables the parties to the convention to better carry out the substantive provisions of the convention which allocate taxing rights. The role of the competent authorities in Article 25 is to ‘endeavour to resolve’ by mutual agreement any difficulties/doubts/disputes arising as to the application of the convention.

- Article 25 of OECD/UN Model Convention deals with MAP.

- Article 25(1) provides that MAP can be invoked by person if he considers that the action of one or both the contracting states result or will result in taxation not in accordance with the provisions of the Convention. Further, the case can be presented to the competent authority of the contracting state of which he is national irrespective of remedies provided in the domestic laws and the same should be presented within three years from the first notification of action resulting in taxation not in accordance with the provision of Convention.

- Article 25(2) states that if the objection of the taxpayer appears to be justified and the competent authority is not able to arrive at the solution the competent authority shall resolve the case by mutual agreement with the competent authority of the other state so as to avoid double taxation. Further, it states that any agreement reached shall be implemented notwithstanding any time limits in domestic laws of the Contracting states.

- Article 25(3) authorizes the competent authorities to resolve difficulties of interpretation or application of the convention by resorting to MAP. For this purpose, the Convention contemplates a continuous dialogue between the competent authorities of the state for exchange of views and opinions.

- Article 25(4) provides that the competent authorities may communicate with each other directly for the purpose of reaching the agreement.

- Article 25(5) deals with arbitration of unresolved issues in a MAP case. It broadly provides that in cases where the competent authorities are unable to reach an agreement under Article 25(2) within two years, the unresolved issues will, at the request of the person who presented the case, can be solved by arbitration.

- In UN Model Convention, two alternative versions, Article 25 (Alternative A) & Article 25 (Alternative B) are given. Article 25 (Alternative A) of UN model is similar to Article 25 of the OECD Model Convention with the addition of second sentence in paragraph(4) and exclusion of arbitration clause. Article 25 (Alternative B) of UN model is similar Article 25 of the OECD Model Convention with the addition of second sentence in paragraph(4) and inclusion of arbitration clause in Article 25(5).

- Certain other issues surrounding MAP :

- Time limits: Generally, two issues arises on time limits in connection with MAP:

- Time limit within which MAP must be initiated: Generally time limits are defined in Article 25(1) of the tax treaty. As per the model tax treaties, the procedure for MAP should be commenced within three years of first notification of action resulting in taxation not in accordance with the Convention.

- Question of domestic time limits and implementation of mutual agreements: Second sentence of Article 25(2) states that any agreement shall be implemented not withstanding the time limits under the domestic laws.

- Binding nature of MAP agreements: The taxpayer may be asked whether he accepts the results of the agreement and if he does then it may be binding on taxpayer as a contract.

- Applicability of mutual agreement procedures for subsequent years: The MAP of a particular year even if accepted by the taxpayer is not binding on him for later years.

[1] Reference in this regard can also be drawn from Para 8 of the OECD Model commentary as it lists common cases that would fall in purview of MAP

Understanding Games theory – Part 1

- Games in general is interaction between two or more people where the outcomes of interactions depends on what everybody does and everybody has different level of happiness for different outcomes.

- Games theory are strategic interactions amongst self interested agents. Often it is referred to as mathematical modelling tool. It is always interesting to analyse how interactions between agents are structured in order to lead good outcomes.

- Some questions that needs consideration –

- All possible actions that can be taken by the players of the game?

- Does it matter if the player of the game think that the opponent is rational

- What effects would communications have?

- Many decisions are taken in a competitive situation in which the outcome depends not on that decision but rather on the interaction between the decision maker and that of its competitors.

- Often following assumptions are made in the games theory – a. There are finite number of participants called players b. Each player has finite number of strategies c. The participants know the rules governing the game d. There is conflicting interest between the participants e. Every game results in an outcome f. The gain of the participant is dependent upon the decision of his opponent and his own game

<<The aim of this series is to explain the concept of games theory through series of posts and analyse whether games theory could be helpful in determination of profit allocation for taxation of digital economy>>

Controlled foreign corporation rules – Part 1

Overview of Controlled Foreign Corporation (CFC) rule –

- Controlled foreign company (‘CFC’) rules have become significant policy instrument for governments in their attempt to curb profit shifting by multinational companies and to protect tax bases. CFC rules applies generally to passive income like interest payments and royalties which can easily be placed in affiliates in tax havens without having a substantial physical presence there.

- CFC rules stipulate a minimum tax rate that must be levied in a host country, in order to avoid additional taxation in the parent country. Thus, CFC rules reduce the tax gain for multinationals from placing valuable assets in a tax haven.

- Certain points in relation to the taxation of CFC income –

- First, an ownership threshold is used to determine whether an entity is considered a controlled foreign corporation. Most European countries consider a foreign subsidiary a CFC, if one or more related domestic corporations own at least 50 percent of the subsidiary.

- Second, once a foreign subsidiary is considered a CFC, there is a test to determine whether the subsidiary’s income should be taxed domestically. Most European countries determine a subsidiary taxable if the foreign tax jurisdiction levies a tax rate below a certain threshold and/or a certain share of the income is passive.

- Third, once a foreign subsidiary is considered a CFC and its income is taxable domestically, a country defines what income earned by the foreign subsidiary is subject to tax.

- CFC income is calculated according to the arm’s length principle, in cases where the non-genuine arrangements rule applies. The amount of income to be included in the tax base of the taxpayer is limited to amounts generated through assets and risks which are linked to significant people functions carried out by the controlling company in cases where it is derived from non-genuine arrangements that have been put in place for the essential purpose to obtain a tax advantage. Other relevant considerations, after the computation of CFC income in any of the alternatives, include:

- The attribution of CFC income;

- Timing of the inclusion;

- Eliminating a second level of tax in the event of a distribution of pre-taxed profits from a CFC.

- Objective of CFC rules –

- Bringing the tax net income within the parent country which may be deferred indefinitely or even remain permanently outside the scope of jurisdictional taxation

- These rules target multinational companies’ ability to shift passive or other types of mobile income to low-taxed jurisdictions

- Developing the taxing regime that would minimize the disincentive to bring the income into the parent jurisdiction

Interpretation of make available clause in the tax treaties – Part 1

There are various issues that arises when it comes to taxability of fess for technical services (FTS) and one such being the interpretation of make available clause in the tax treaties. The concept of ‘make available’ clause in the tax treaties means the person aquiring the services is equipped to apply the technology or technical knowledge or technical expertise contained therein in future.

Taxability as per Income tax Act, 1961 (ITA) –

Section 9(1)(vii)(b) of the ITA provides that FTS shall be deemed to accrue or arise in India where such FTS is payable by a resident. It may be noted that the condition of ‘make available’ doesnot exist in the provisions of ITA dealing with FTS.

Taxability as per Double tax avoidance agreement (DTAA) –

The defination of FTS (in some DTAA’s it is instead of FTS article there is Fees for included services article) is more restricted in DTAA where it requires satisfaction of ‘make available’ condition. India’s tax treaties with Australia, Canada, Cyprus, Malta, Netherlands , Singapore, US and USA contain the concept of make available concept. Many DTAA does not have make available clause but MFN clause can be invoked to import the concept of make available clause from other DTAA’s.

Where the DTAA contains the concept of make available, technology or technical knowledge or technical expertise should be ‘made available’ or parted/ provided or transferred by the service provider to the service recepient for use in the future.

Reference can be made to the judegement of Intertek Testing Services India (P.) Ltd. (In re [2008] 307 ITR 418 (AAR)).Conditiond to be satisfied for make available clause are –

- Technical knowledge, skills, etc. must remain with the person receiving the services even after the agreement comes to an end

- The technical knowledge or skills of the provider should be imparted to the recipient

- The recipient should be in a position to deploy similar skills or technology or techniques in future without the aid or assistance of the service provider

DTAA’s generally does not define the meaning of make available clause. Only, Memorandum of Understanding appended to India-US DTAA provides for the detailed explanation of make available clause. Relevant extracts are reproduced below –

“Generally speaking, technology will be considered “made available” when the person

acquiring the service is enabled to apply the technology. The fact that the provision of the service may require technical input by the person providing the service does not per se mean that technical knowledge, skills, etc., are made available to the person purchasing the service, within the meaning of paragraph 4(b). Similarly, the use of a product which embodies technology shall not per se be considered to make the technology available.”

(Emphasis supplied)

There has been controversies on the scope of application of Make available clause. The same shall be discussed in next part.

Impact of most favoured nation clause – Part 1

Background –

- Most Favoured Nation (‘MFN’) clause has a long history. World Trade Organisation (‘WTO’) generally requires its members to grant one another MFN status It exists in wide range of trade agreements. Further, unlike international tax laws which are only bilateral in nature, trade agreements has wide variants.

- Different tax treaties are negotiated under different political/ social/ economic factors hence the benefits accorded by different tax treaties varies. OECD model convention doesnot have MFN clause. Since, many tax treaties are modelled on OECD model convention, the absence of such a clause in the OECD model convention is a clear indication that MFN treatment is not general rule of international tax law.

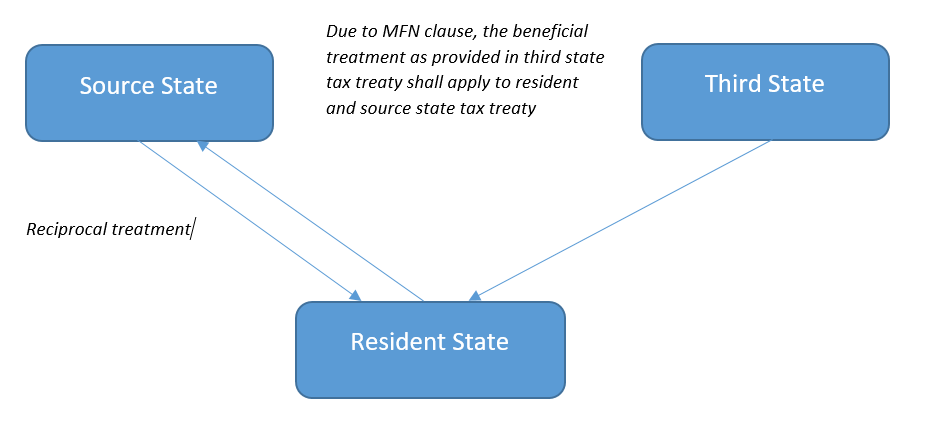

- These are provisions in tax treaties under which one of the contracting state to the tax treaty agree to accord to the other contracting state, treatment that is no less favourable than which it accords to other or third states. The MFN treatment prevents discrimination among foreign investors of different nationalities and allows the creation of a level playing field. Also, MFN clause has reciprocal application, India entities may claim benefit in respect of income received by them from abroad from their dealings with foreign entities.

- Usually found in Protocols and Exchange of Notes to tax treaties, it tries to avoid discrimination between residents of different countries. The object of the MFN clause are – To guarantee that no discriminatory treatment when compared with a third Country and to offer a better treatment because of a favorable change in policy

- MFN clause in tax treaties are not general but are restricted to certain aspects. MFN clause in India context relates it –

- Rates of withholding

- Scope of applicability of tax treaty clauses

- Allowability of deduction/ expenses

- Working of the MFN clause is illustrated in the below diagram –

- Points that needs consideration while applying MFN clause :

- Date of applicability of MFN clause : It can be either the date of signing of the tax treaty or date of entry into force or the effective date

- Reference should be placed on treaties of which country (OECD countries or Non-OECD countries)

- Scope of MFN clause

- In the past CBDT has issued notifications in relation to India-Netherlands, India-Belgium and India-France tax treaties, explaining the changes in the respective tax treaties due to the MFN clause. It is yet to be seen if CBDT comes out with a detailed clarification on various aspects of the applicability and effective utilization of MFN clause to give effect to the intention behind the introduction of MFN clause under the tax treaties.

- Snapshot of the some of the Indian tax treaties which has MFN clause

| OECD member countries | Belgium, France, Hungary, Netherlands, Norway, Spain, Sweden, Finland, Swiss Confederation, United Kingdom and Israel |

| Non-OECD member countries | Kazakhstan, Philippines, Saudi Arabia and Sri-Lanka |